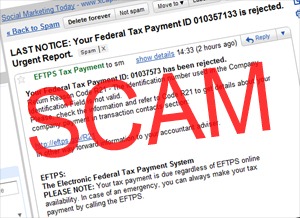

Last year there had been reports of many people getting called by someone claiming to be from the IRS only to be harassed for money they owe and often being threatened. It seems the same scam is occurring this tax season but on a much larger scale and to a much larger group of people. Last year they targeted new immigrants for the most part while they are now calling people everywhere. These fake IRS agents have targeted nearly 366,000 people and over 3,000 people have fallen for the scam.

The IRS usually contacts you by mail, so a phone call is quite rare and they never demand payment by debit card, credit card, or wire transfer. A lot of the fake IRS agents will demand payment by prepaid debit cards because it is difficult to track and not attached to a bank account. If you get a phone call from someone claiming to be from the IRS and asking for money you should do one of two things:

- If you think you owe back taxes, hang up and call the IRS at 800-829-1040.

- If you know you don’t owe taxes, hang up and call the IRS at 800-366-4484 to report the incident.

Along with knowing how to handle the situation, the IRS has also released these tips to help avoid the scam.

- The IRS will never call you on the phone to demand immediate payment

- The IRS will never call you about taxes owed without mailing you a notice.

- The IRS will never demand that you pay taxes without giving you the opportunity to question or appeal the amount the agency says you owe.

- The IRS will never require you to use a specific payment method for your taxes, such as a prepaid debit card.

- The IRS will never ask for credit card or debit card numbers over the phone.

- The IRS will never threaten to have you arrested for not paying.

Consult with your local CPA at Cartlidge, Cartlidge & Co. if you have questions regarding tax scams.

Al & Staff