Social Security perk to reduce after 2020

If you withdraw at age 62, your Social Security monthly benefit is permanently reduced. If you wait until after full retirement age to retire, you earn delayed retirement credits that can increase the size of your monthly check from Social Security by two-thirds of a percent each month. This has been in place for years, but 2020 is the last year to get the highest benefit of the retirement credits. After 2020, the amount of retirement credits that could be potentially earned will decrease as the full retirement age will increase by two months...

read moreMake your tax appointment today!

Scheduling appointments starting February 3rd Call us at 775-826-3496 Office hours Mon-Fri 8:00 a.m. to 5:00 p.m. Or if you prefer, you can drop off your documents at the front...

read moreUpdate on the Health Care Mandate

The Individual Shared Responsibility Payment no longer exists at the federal level. What does this mean for you? In prior years, taxpayers had to pay a fee or were penalized on their taxes if they could afford health insurance, but did not purchase it or did not have a coverage exemption. Now for the 2019 tax season, that penalty has been reduced to zero meaning that you are no longer penalized for not having health insurance on your federal tax returns. You won’t have to pay a penalty for not having health insurance or a coverage exemption...

read moreTAX SEASON IS HERE!

Welcome to 2020! It is time to get your tax, investment, and financial matters in order. We look forward to helping you in the upcoming months. Individual returns will be impacted by four major tax law changes. Five of the seven tax rates dropped 2-4%. Exemptions are no longer available. Standard deductions nearly doubled for everyone. Some businesses may qualify for new 20% deductions. Please take a moment to call us to set up your appointment. We will begin tax appointments on Monday, February 17, 2020. Our tax season...

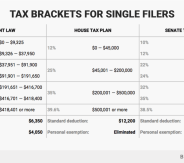

read morePOSSIBLE NEW TAX LAWS FOR 2018

Tax reform is making progress, but there’s still a long way to go according to AP/Alex Brandon. - Income tax brackets could change in 2018 if tax legislation is enacted under President Donald Trump. -The Senate’s bill proposes keeping seven tax brackets but changing the income ranges, while the House’s version of the bill would reduce the number of tax brackets to four. -Both plans propose eliminating the personal exemption and increasing the standard deduction. House and Senate Republicans have taken two different...

read morePosted in the Wall Street Journal:

The boldest ideas for changing the nation’s tax code are either dead or on political life support, as the Republican effort in Congress to reshape the tax system moves much more slowly than lawmakers and their allies in business had hoped. Republicans, who control both chambers, are scouring the tax code, searching for ways to offset the deep rate cuts they desire. But their proposals for border adjustment, which would tax imports and for ending the business interest deduction and making major changes to individual tax breaks for...

read more

Find us online!